Securities lending can be a lifeline, especially when you need cash quickly. You might suddenly need cash for a financial emergency or critical repairs around the house.

The way a Florida car title loan works is fairly straightforward. You provide the lender with title to your vehicle as security for the loan. They will usually give you the money you need very quickly so that you can use it to solve your financial problems.

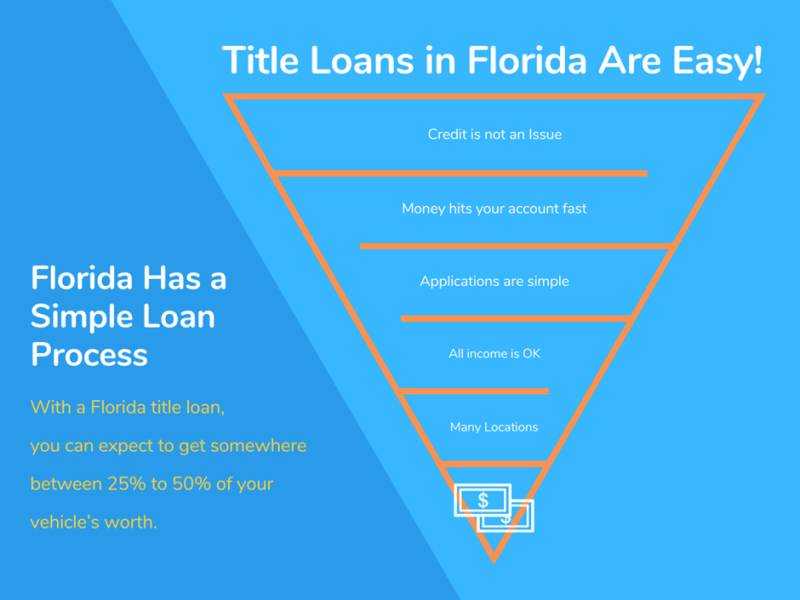

“But how much can I realistically expect to get from a Florida title loan?“That’s a great question. With a title loan in Florida, you can expect to get between 25% and 50% of your vehicle’s value. According to some statistics, title deed borrowers can get as low as $ 100.00 and up to $ 5,500.00.

How To Get A Title Loan In Florida

Getting a Florida Title Loan is Quick and Easy!

Determine how much you need

First of all, you need to determine how much money you need. Smart borrowers will never withdraw more than enough to overcome their current financial difficulties. That way, they won’t spend the extras on something unnecessary. Most importantly, they won’t have to pay back more money than necessary or go into debt longer than necessary.

Prepare the necessary documentation

You don’t need a lot of documents to apply for a Florida title loan. All you need to get started is …

- Your photo ID

- The title of the vehicle proves that you are the rightful owner.

In some cases, the lender may ask for some sort of proof of residency, like a utility bill or something similar.

Find a lender online or locally

The next step is to find a trusted direct lender near you. Unfortunately, most local lenders have closed their storefronts due to COVID-19 and are now offering securities lending online. Here are some highly rated lenders in Florida who can process applications online or locally:

- Titlelo securities lending – Online only

- Embassy loans – Local and online

- Credex – Local only

Once you’ve chosen the right lender, go to the lender’s website and complete your application. Make sure you submit all the necessary documentation mentioned earlier in this list and any other that the lender might ask you. Once you have made your request, a loan officer will contact you to help you through the process. Usually, it doesn’t take long for this to happen. If your application is approved, then you will know how much the lender will offer you. At the same time, you can also determine the repayment terms and timing of this auto loan in Florida.

Read the fine print

Whatever happens, always read the fine print before signing anything. You need to know all the facts before you commit to it!

In addition, as a savvy borrower, you will be able to earn many better informed decisions later when you know the terms of your title loan.

Use the money wisely

Once you’ve got the cash you need, make sure you’re using it wisely. Remember why you borrowed it in the first place, and make sure you resolve that financial need as soon as possible. After all, you don’t want to end up spending that money on other things first!

Common questions

You might have some questions that come to mind about a Florida title loan. Do not worry! It is always a good idea to ask these questions before submitting your application. Here are two of the most common questions about securities lending:

Can I get a title loan if my credit is bad?

Yes you absolutely can! When it comes to securities loans, lenders generally do not consider your credit score as part of the application process. This is why securities loans are so useful in difficult times!

Do I need a specific type of income to qualify for a title loan?

No! Florida title lenders will work with you regardless of your income type. Whether you are a business owner, on-demand worker, or freelance writer without a regular monthly salary, you can still apply for a title loan!

Below is a graph with the most important points we have covered:

Courtesy photo: Jeremy brooks